lake county tax bill indiana

CUSTODIAN OF PUBLIC RECORDS. Lake County Tax Collector.

Lake County Indiana Public Records Directory

The Department of Local Government Finance has compiled this information in an easy-to-use format to assist Hoosiers in.

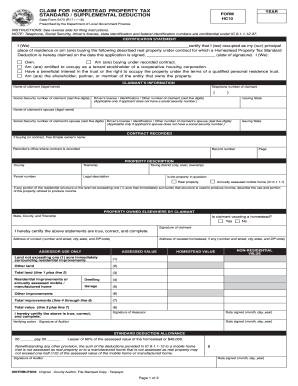

. Make sure the tax year is set to the right year. Senior citizens as well as all homeowners in Indiana can claim a tax deduction if their home serves as their primary residence. For example 2019 taxes are payable and billed in 2020.

Ad Search Lake County Records Online - Results In Minutes. See detailed property tax information from the sample report for 2792 Cypress Ln Lake County IN. House Bill 1319 - Lake County innkeepers tax - Indiana General Assembly 2017 Session.

Property taxes in Indiana are overseen by the Indianas Department of Local Government Finance and administered and collected by local government officials and represent a primary source of funding for local government units including counties. Median Property Taxes Mortgage 1752. These fees are not retained by Lake County and therefore are not refundable.

This exemption provides a deduction in assessed property value. 6686076 email addresses are public. 2 removal of a member of the Lake County convention and visitor bureau.

The median property tax in Lake County Indiana is 1852 per year for a home worth the median value of 135400. School districts get the biggest portion about 69 percent. Ad Valorem Taxes Ad valorem is a Latin phrase meaning according to worth.

The deduction amount equals either 60 percent of the assessed value of the home or a maximum of 45000. Lake County collects on average 137 of a propertys assessed fair market value as property tax. Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe.

These records can include Lake County property tax assessments and assessment challenges appraisals and income taxes. Median Property Taxes No Mortgage 1395. Additionally some municipalities within the counties may have their own FAB tax.

To Print a Tax Bill. Please note there is a nomimal convenience fee charged for these services. Law Enforcement Academy Indiana.

1 uses of the innkeepers tax. Lake County Tax Bill Indiana. Lake County has one of the highest median property taxes in the United States and is ranked 540th.

Lake County innkeepers tax. Lake County tax valuation methods. Checks cashiers checks and money orders can be mailed to.

The Federal Government has provided Coronavirus Local Fiscal Recovery Funds Recovery Funds through the American Rescue Plan Act ARPA to provide relief to local governmental units as a result of the COVID-19 Pandemic. Treasurer - It collects various taxes including local and state property taxes inheritance taxes and delinquent taxes. Wednesday 2 March 2022 Edit Median real estate taxes paid 1678 1207.

Find Lake County Property Tax Info From 2021. Disable your popup blocker and click Go. Any changes to the tax roll name address location assessed value must be processed through the Lake County Property Appraisers Office 352 253-2150.

Electronic Payments can be made online or by telephone 866 506-8035. The information provided in these databases is public record and available through public information requests. As part of our commitment to provide our customers with efficient and convenient service The Treasurers Office now offers tax payments over the Internet using major credit cards and e-checks.

Treasury Department the Treasury Department awarded Lake County Indiana the County 94301324 in Recovery. Food and Beverage Tax FAB Local Income Tax LIT All counties will have a LIT rate but not all counties have CIT or FAB taxes. While taxpayers pay their property taxes to the Lake County Treasurer Lake County government only receives about seven percent of the average tax bill payment.

After reviewing the Tax Summary click on Tax Bill in the right hand column. In accordance with 2017-21 Laws of Florida 119 Florida Statutes. This service only accepts one-time full or partial payments.

137 of home value. Certain types of Tax Records are available to the general. Urges the legislative council to assign to an appropriate interim study committee the task of studying the issue of the impact that tax valuation methods for steel mill equipment oil refinery equipment and petrochemical equipment have on.

The median property tax in Lake County Indiana is 1852 per year for a home worth the median value of 135400. Yearly median tax in Lake County. Main Street Crown Point IN 46307 Phone.

The tax offices are working in the 2020 year which corresponds to the property tax bill property owners will receive in early May of 2021. 255 N Forbes Street Rm 215. Lake County Property Tax Payments Annual Lake County Indiana.

Office of the Lake County Tax Collector 320 West Main Street Tavares Florida 32778 Phone. Lake County Property Tax Payments Annual Lake County Indiana. To print a tax bill please enter your ten-digit PIN.

Lake County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Lake County Indiana. Please note there is a convenience fee of 25 for creditdebit card payments or a 300 flat fee for an e-Check. Make sure the tax year is set to the right.

And 3 authority to enter into leases for the constru. Jordan Lake County Tax Collector 320 West Main Street Tavares Florida 32778 Under FS. Discover Lake County Indiana Tax Bill for getting more useful information about real estate apartment mortgages near you.

The Treasurer sends out tax bills and collects and distributes funds for all Lake County taxing districts. Lake County tax valuation methods. Please call us at once if you did not receive your bill or if you have any indication that your tax bill may have been misdirected.

ALL LENDERS TITLE COMPANIES WITHOUT THE ORIGINAL TAX BILL MUST. The sales tax for the entire State of Indiana is 7. All rates will be updated using the best information DOR has available.

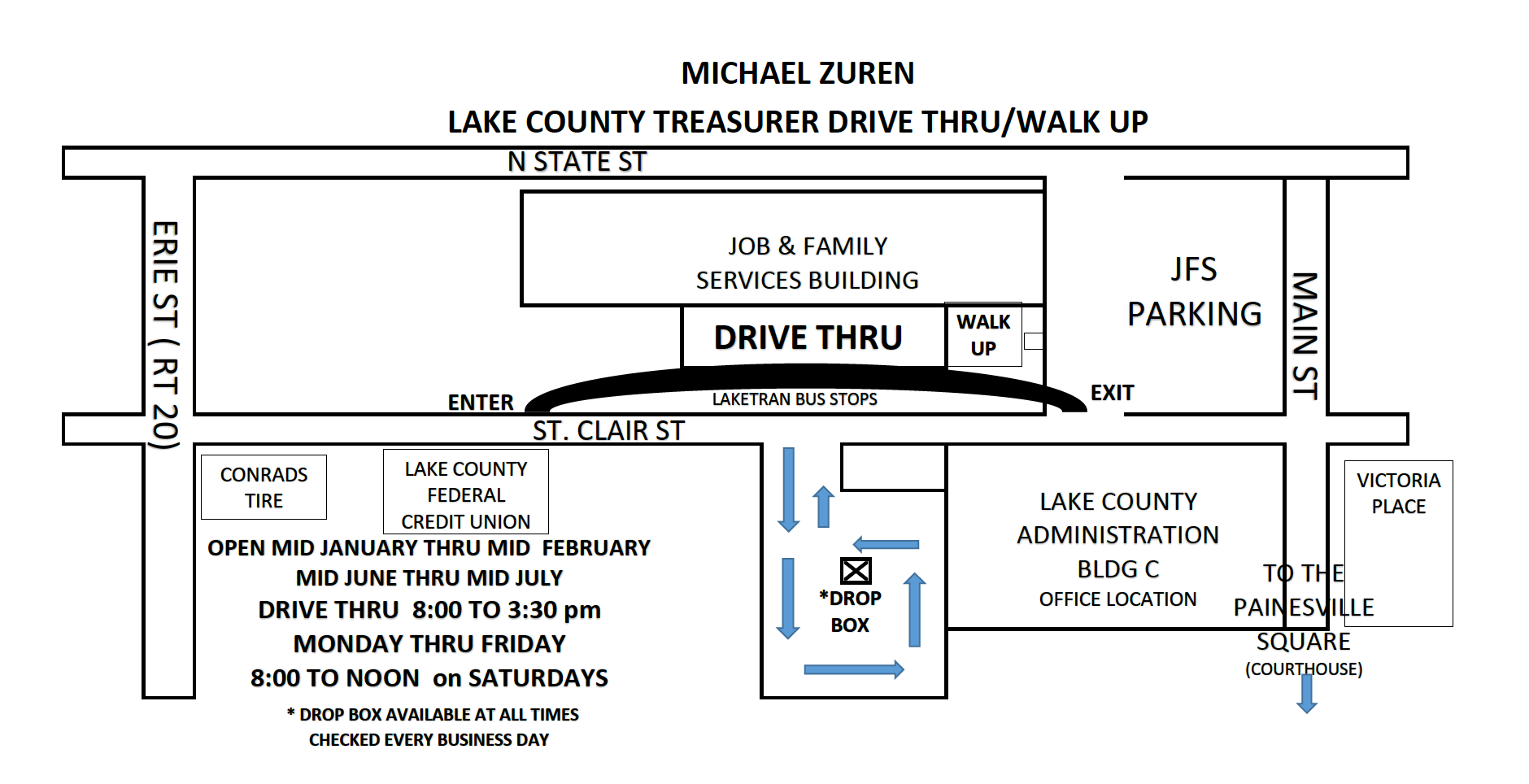

Michael Zuren Lake County Treasurer 105 Main Street Painesville Ohio 44077 Office Open 800 AM To 430 PM-Monday Thru Friday Holidays Excluded Phone. Amends the Lake County innkeepers tax statute concerning. 440350-2516 Painesville 440918-2516 West End And.

Lake County Auditor 2293 N Main St Crown Point In 46307 Usa

Indiana Property Tax Calculator Smartasset

The New Age In Indiana Property Tax Assessment

Property Tax Rates Across The State

Indiana Supreme Court To Determine Assessed Value Of Southlake Mall Crime And Courts Nwitimes Com

Indiana Homestead Exemption Form Fill Out And Sign Printable Pdf Template Signnow

The New Age In Indiana Property Tax Assessment

Property Taxes Lake County Tax Collector

Property Tax Rates Across The State

Additional Information On Property Taxes

Who Pays Lake County S Biggest Property Tax Bills

The New Age In Indiana Property Tax Assessment

Lake County Il Property Tax Information